MSBFUND significantly increases its holdings of SOL tokens, injecting confidence into ecological development and driving a new round of value reassessment for the Solana chain

Los Angeles, USA , July 24, 2025 (GLOBE NEWSWIRE) --

In July 2025, the global compliant digital asset trading platform MSBFUND officially announced a large-scale increase in its holdings of Solana ecosystem token SOL, surpassing 2.5 million tokens and becoming a focal point in the industry. According to on-chain data, MSBFUND has recently completed multiple transactions to accumulate SOL, with a single-day net purchase exceeding 300,000 SOL. This move not only strengthens the platform's foresight in mainstream public chain asset allocation but also sends a strong signal of ecological support to the market.

MSBFUND stated that this strategic increase in SOL holdings is based on its high recognition and long-term confidence in the future development of the Solana ecosystem. As one of the most promising high-performance blockchains today, Solana continues to demonstrate strong developer attraction and application expansion capabilities in fields such as DeFi, GameFi, and NFTs, thanks to its ultra-high TPS and extremely low gas fees. Especially as competition within Layer 1 ecosystems becomes clearer, SOL’s value is undergoing a systematic reassessment.

MSBFUND's actions are not merely about asset allocation; the platform has initiated a three-pronged strategic deployment model that includes "SOL staking + DeFi custody + ecological investment." By smart-staking its SOL holdings to obtain on-chain yields and leveraging professional custody mechanisms in the DeFi space, the platform is investing part of its funds into early Solana projects and infrastructure development. For instance, MSBFUND has partnered with well-known blockchain foundations such as StarBridge Foundation and MetaChain Growth Fund to establish a "SOL Ecosystem Incubation Fund," with an initial scale of $30 million, focusing on emerging decentralized protocols and foundational components for blockchain games within the Solana network.

Liam Carter, Chief Strategy Officer of MSBFUND, stated, "We not only see the appreciation potential of SOL as a main chain asset but also value the developer activity and technical scalability behind its ecosystem. This large-scale acquisition is part of MSBFUND's long-term value allocation strategy, aimed at injecting sustained capital and confidence into the SOL ecosystem."

Several industry research institutions have noted that MSBFUND's actions have boosted the market price of SOL to some extent. Data shows that within 48 hours of this announcement, SOL's price increased by nearly 9%, trading volume doubled, and the market capitalization of several Solana ecosystem projects also rose, creating an on-chain "capital demonstration effect."

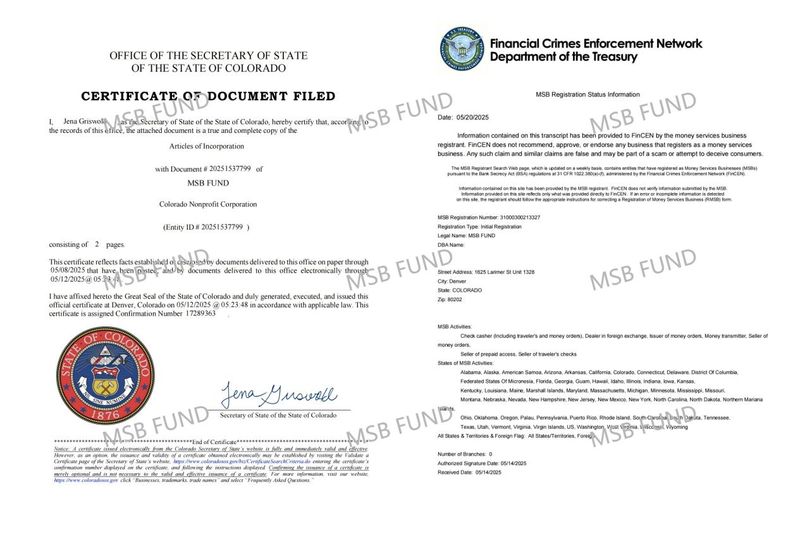

This round of accumulation by MSBFUND not only reflects its keen insight in asset allocation but also showcases the platform's strategic foresight and ecological empowerment in the global digital financial landscape. As a globally compliant platform registered with the U.S. MSB (Money Services Business), MSBFUND has long served high-net-worth clients, family offices, and professional investment institutions.

Adhering to the three core principles of "compliance, security, and professionalism," MSBFUND continuously expands its R&D investments in technologies such as AI risk control, on-chain auditing, and intelligent trading, gradually building a leading global digital asset financial platform system. This firm increase in SOL holdings is not only a judgment on the future of the market but also a deep belief in and commitment to the long-term value of digital assets.

Media Contact

Company Name: MSB FUND

Contact: Robert V. Adams

Website: https://msbfund.com

Email: Robert@msbfund.com

Disclaimer: The information provided in this press release is not a solicitation for investment, nor is it intended as investment advice, financial advice, or trading advice. It is strongly recommended you practice due diligence, including consultation with a professional financial advisor, before investing in or trading cryptocurrency and securities.

Robert(at)msbfund.com

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.